Accelerated Change

Key contact

The first six months of 2020 have seen a sharp slowdown in activity around the world, and this is reflected in our polling of sector leaders controlling assets worth hundreds of billions of pounds.

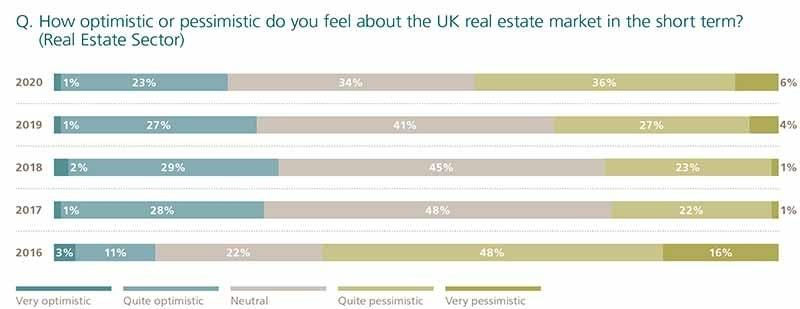

How far that optimism has been punctured is illustrated by our poll, with 42% of sector leaders saying they are pessimistic compared with 31% in 2019 and 24% in 2018.

The pandemic has caused unprecedented disruption across the industry and appears likely to accelerate investment trends and themes. Distribution and logistics take the top spot and have continually gone from strength to strength, with 84% describing the asset class as ‘appealing’ compared with 64% back in 2016. Healthcare is second in asset class appeal with a significant increase to 71%, up from 58% last year. The Private Rented Sector (PRS) and residential continues to be a strong performer. For retail, prospects only continue to deteriorate.

The office sector has taken an inevitable hit. However, the office market isn’t ‘dead’, but businesses need to continue to adapt to the changing circumstances and the ways of working