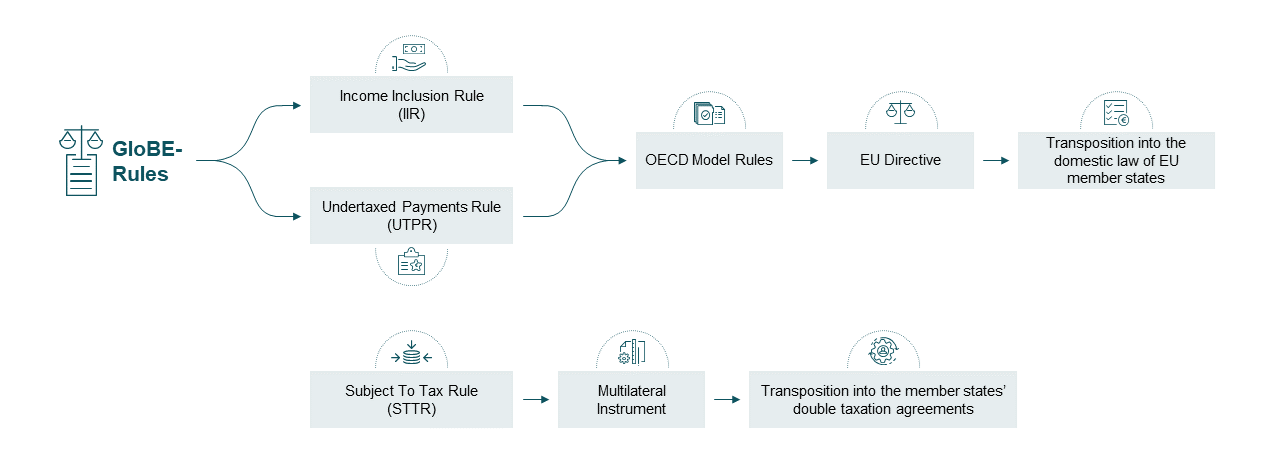

Uniform transposition of GloBE Rules in the single market by way of a EU directive

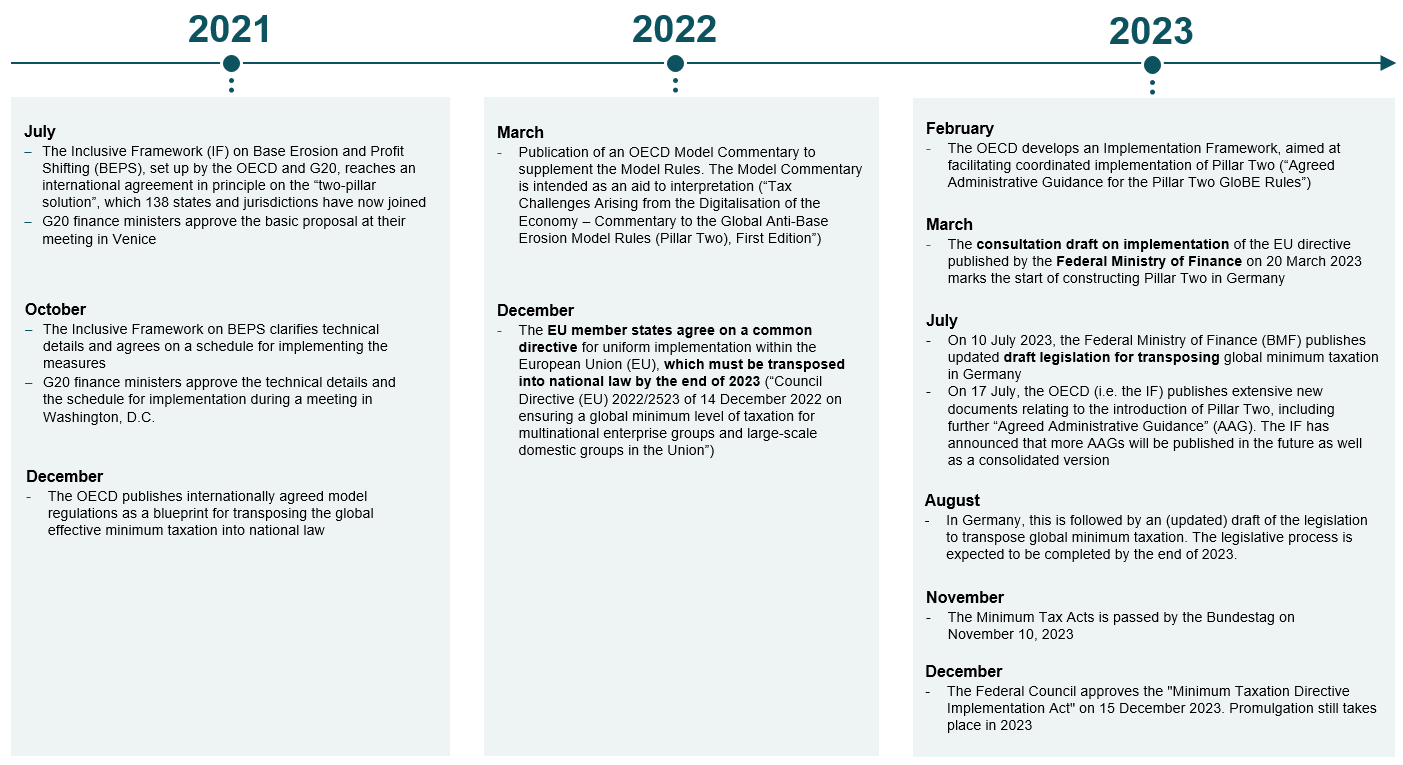

When the OECD initially published the Model Rules for uniform transposition of GloBE Rules in the participating states on 20 December 2021, the European Commission presented a draft directive on 22 December 2021 aimed at ensuring harmonised transposition of the GloBE Rules within the EU. The directive was adopted by the EU in December 2022 (Council Directive [EU] 2022/2523 of 14.12.2022 on ensuring a global minimum level of taxation for multinational enterprise groups and large-scale domestic groups in the Union (“Minimum Taxation Directive”)). The directive requires all member states, including Germany, to transpose the rules into domestic law by 31 December 2023. The content largely follows the OECD’s Model Rules, but also includes some adjustments to ensure compliance with European law.

The Model Rules have been given the status of a common approach by the OECD, i.e. participating states are not required to adopt the rules. If they choose to do so, however, they must adhere to the stipulations of the IF. At all events, states are required to accept application of the rules by other member states. Unlike the OECD Model Rules, the GloBE Rules in the EU directive are not designed as a common approach. Instead, the directive stipulates mandatory transposition of the GloBE Rules within the single market by EU member states. The directive also goes beyond the Model Rules in that purely national corporations will fall within its scope. The directive’s requirements are binding on the German legislator, which must transpose them into national law.

The directive stipulates that member states must transpose it by 31 December 2023, with most of the provisions applicable from 1 January 2024.

Transposition of global minimum taxation in Germany

The arrangements for a global minimum tax have high priority for the German legislature. As a result, the legislative process currently under way is being driven forward at pace, with completion expected in the second half of 2023.

Overview:

- 20.03.2023: The Federal Ministry of Finance (BMF) presented a consultation draft of a Minimum Tax Act (MinStG) to transpose the directive and gave industry bodies an opportunity to comment on it.

- 10.07.2023: The BMF sent an updated draft bill (as at 7.7.2023) to the industry bodies. This initiated the formal legislative process, with numerous (detailed) amendments compared to the consultation draft.

- 16.08.2023: The German federal cabinet adopted draft legislation for a Minimum Taxation Directive Implementation Act (MinBestRL-UmsG), which was amended once again compared to the draft bill.

- 29.09.2023: The German Federal Council (Bundesrat) issued its opinion on the draft law.

- 10.11.2023: The German Federal Parliament (Bundestag) passes the amended "Minimum Taxation Directive Implementation Act".

- The Federal Council approves the "Minimum Taxation Directive Implementation Act" on 15 December 2023. Promulgation still takes place in 2023.

Ready for global minimum taxation – how we can assist you at CMS Germany and worldwide

With more than 70 locations across over 40 countries and more than 5,000 lawyers worldwide, we combine in-depth local expertise with an understanding of the global context. Our international CMS organisation enables us to offer you coordinated legal advice and support at any time, in and from Germany, as you deal with global minimum taxation and its implementation.

Our comprehensive range of services around global minimum taxation includes:

Social Media cookies collect information about you sharing information from our website via social media tools, or analytics to understand your browsing between social media tools or our Social Media campaigns and our own websites. We do this to optimise the mix of channels to provide you with our content. Details concerning the tools in use are in our privacy policy.