Carried interest

For closed-ended funds carry remains anchored around 20% of fund profits after return of principal and hurdle across the asset classes. However, we have seen some alternatives including:

- High Carry: A new trend seems to be emerging where a small number of top managers who perform very well in the resilient sectors (such as technology and distribution) can demand higher carry.

For technology-focused venture capital funds, there is some evidence of a developing market normal for a second tier of 25% carry above a 3x return. For some managers with a strong track record there is even higher carry for outstanding returns. - Ratchet-based Carry: Where the manager has a higher carry percentage as the fund achieves additional benchmarks.

- Different combinations of Carry/fees: Where a higher fee attracts lower carry and vice versa.

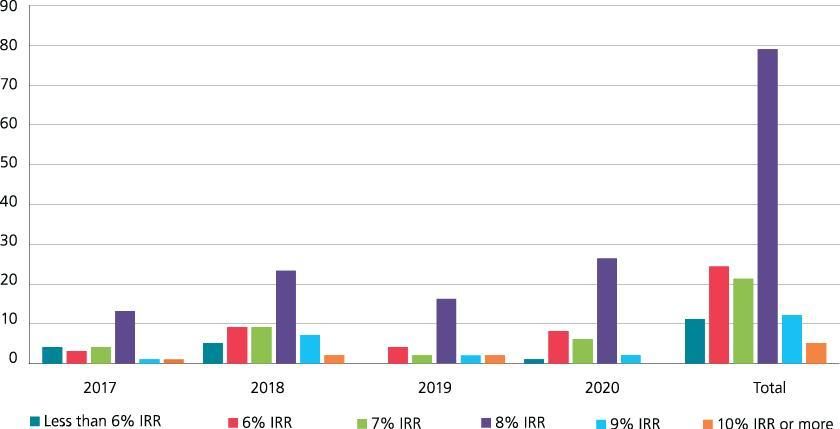

Hurdle Rate

An 8% hurdle rate remains the most common across all asset classes.

Sample Funds Promote: Hurdle

Basis for distribution: Whole Fund vs Deal-by-Deal

Whole fund waterfall is the predominant model for Europe and Asia in our Sample Funds.

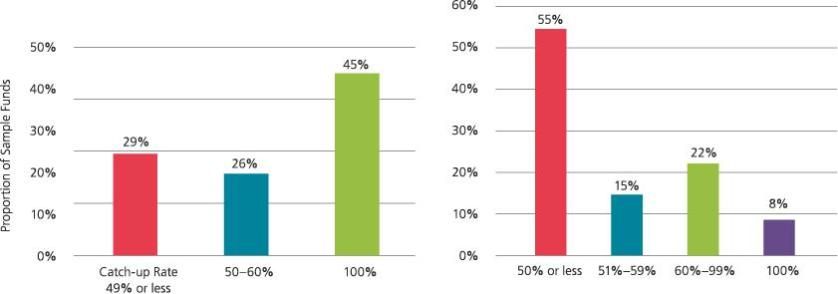

Catch-up Rate

Once investors have received profits equal to the hurdle, typically the carry holders are entitled to receive a percentage of the pre-hurdle profits to catch-up with the investors. Historically, carry holders received 100% of catch-up distributions to catch-up to the position of investors.

Whilst this remains common for private equity funds, a lower rate of catch-up is more common for real estate funds, typically around 50%, with no catch-up in some instances (although hurdle rates may be lower or ratcheted in these situations).

Escrow, Claw-Back and Guarantees

It is common for carry to be subject to a clawback on termination of the fund (including both Deal-by-deal and Whole fund waterfalls), with escrows continuing to be common in Deal-by-deal funds. We are also starting

to see a growing request for fund manager guarantees although these are still generally resisted.