Back to Basics | UK PSC Regime

Authors

Published in April 2022

Outline

The PSC regime should be considered in the context of funds and real estate holding structures wherever a relevant UK entity appears. Certain UK registered companies, limited liability partnerships (“LLPs”) and Scottish partnerships are required to identify persons who have significant control (“PSCs”) over their interests and affairs by publicly disclosing and maintaining their details in a “PSC Register”.

The PSC legislation is intended to promote transparency within UK holding structures by making information on beneficial owners publicly available. Individuals can meet the PSC criteria by virtue of direct or indirect interests in the underlying entity and UK companies (and overseas companies that are listed in the UK or on certain overseas markets) may also appear on the PSC Register. More than one person or registrable legal entity may appear on an entity’s PSC Register.

The PSC regime analysis is not always straightforward and there can be a number of factors to take into consideration. Failure to comply however, carries criminal penalties, meaning it is important to get it right.

Who does the PSC regime apply to?

The PSC regime has always applied to UK companies and LLPs since its inception in April 2016 but since June 2017, it has also applied to Scottish limited partnerships and Scottish general partnerships whose partners are all corporate bodies (“Eligible Scottish Partnerships”).

In general, UK companies subject to transparency obligations under the Financial Conduct Authority's Disclosure and Transparency Rules (or their relevant overseas equivalent) will be exempt from the requirements but further analysis should be undertaken. The rules as they apply to such companies are outside the scope of this note.

The requirement to maintain a PSC register does not currently apply to other 'non-corporate' entities, such as English limited partnerships.

What do you need to do?

1. Time periods and notification obligations

An entity subject to the PSC Regime has 14 days from obtaining PSC information to notify Companies House of the individual(s) that satisfy the tests to qualify as a PSC.

2. What are the conditions for qualifying as a PSC?

A PSC is an individual or relevant legal entity who meets one or more of the following “Conditions”:

- holds, directly or indirectly, more than 25% of a company's shares (or for LLPs and Eligible Scottish Partnerships, more than 25% of the surplus assets on winding up) (Condition 1);

- holds, directly or indirectly, more than 25% of voting rights in the company, LLP or Eligible Scottish Partnership (Condition 2);

- holds, directly or indirectly, the right to appoint or remove a majority of the company's directors (or for LLPs and Eligible Scottish Partnerships, a majority of those involved in management) (Condition 3);

- has the right to exercise, or actually exercises, significant influence or control over the company (Condition 4); or

- has the right to exercise, or actually exercises, significant influence or control over a trust or firm that is not a legal entity, and meets one of the conditions above (Condition 5).

A “firm” for the purposes of Condition 5 is any entity which does not have legal personality under the law by which it is governed. Partnerships without legal personality, including English limited partnerships, are “firms”. LLPs and Eligible Scottish Partnerships have legal personality and are not “firms” under these criteria.

i. Conditions 4 and 5: “Significant Influence or Control”

The meaning of “significant influence or control” is important to understanding the scope of the Conditions. There is statutory guidance on the interpretation of the terms, which provides a number of non-exhaustive principles and examples to help determine who falls within the regime.

As the guidance details, “significant influence” and “control” are alternatives. Where a person can direct the activities of a company, trust or firm, this would be indicative of “control”. Where a person can ensure that a company, trust or firm generally adopts the activities which they desire, this would be indicative of “significant influence”.

There is no requirement for “significant influence” or “control” to be asserted with a view to making economic gain and the particular circumstances would always need to be considered. But the following examples, if capable of being exercised absolutely by an individual, are likely to result in the individual meeting the criteria:

- rights to determine the adoption/amendment of business plans;

- ability to appoint/remove key persons;

- approval rights over strategic business decisions, including decisions in relation to third-party financing.

This is why the PSC Regime is relevant to real estate and fund holding structures, even where economic ownership may suggest otherwise. For example, analysis of the PSC regime is likely to need careful consideration where investors have ceded day-to-day control for the affairs of the structure to a manager, trustees or one or more of the investors.

Rights for minority investors should also be considered but are unlikely to meet the criteria when exercised with the main objective of protecting capital. Here the statutory guidance refers to investor protection rights, such as the ability to veto borrowing outside of pre-approved limits, change the constitution of the entity and/or alter the nature of the venture’s business as examples that would not imply “significant influence” or “control” when exercised in this context.

ii. Who must be included on the PSC Register?

The PSC Register must include:

- Any individual who is a registrable PSC in relation to that entity; and

- Any relevant legal entities (“RLEs”).

- Relevant Legal Entities or “RLEs”

The focus of the PSC regime is on individuals and not on legal entities. But legal entities that can own and control companies are capable of being entered onto a PSC Register where such entities satisfy one or more of the conditions AND, in turn, are also subject to disclosure requirements ensuring information on their beneficial ownership is available in the public domain. In particular, an RLE would be entered as a PSC because:

- It is required to keep its own PSC Register; or

- It has voting shares admitted to trading on certain regulated markets (albeit further analysis would need to be done in this respect).

Not all RLEs are registrable on a PSC Register, however. An RLE is registrable in relation to another entity if it is the first RLE in the ownership chain. RLEs further up an ownership chain do not need to be included as the information on beneficial ownership can be discovered by looking at that RLE’s register. Unlisted companies registered overseas are generally outside the scope of the PSC regime and will not be capable of being registered.

Example 1: Registrable Legal Entities or “RLEs”:

- The individual is in principle a PSC of Subsidiary, on the basis the individual has indirect control (see below) but individual does not need to be registered on Subsidiary’s PSC Register because the individual holds their interest wholly through an RLE (Parent).

- The individual is entered as a PSC on Parent’s PSC Register. Parent is entered as the PSC on Subsidiary’s PSC Register by virtue of being an RLE.

- Note, if Parent was an overseas company, then it could not be registered and the individual would be registered as Subsidiary’s PSC

Indirect PSCs and companies owned or controlled by other legal entities

iii. Indirect interests

When calculating whether the first three PSC conditions are met (on share ownerships, voting rights and board control), you must count indirect as well as direct interests. Individuals are treated as holding an indirect interest if they have a “majority stake” in that legal entity. You will be deemed to have a majority stake if:

- you hold a majority of the voting rights in the legal entity;

- you are a member of the legal entity and have the right to appoint or remove a majority of its board of directors;

- you are a member of the legal entity and control a majority of the voting rights by agreement with other shareholders or members; or

- you have the right to exercise or actually exercise dominant influence or control over the legal entity.

Example 2: PSCs and RLEs:

- The individual is recorded as the PSC for HoldCo.

- HoldCo is recorded as an RLE on InvestCo’s PSC Register on the basis HoldCo is required to maintain its own PSC Register.

- The individual is also entered as a PSC on InvestCo’s PSC Register because the individual does not hold all their shares via the RLE. Though the 10% holding does not satisfy the criteria alone, the indirect holding via HoldCo means the Conditions are met.

iv. Interests in companies held by limited partnerships

English limited partnerships (including private fund limited partnerships) do not have separate legal personality and are therefore not registrable as a PSC or RLE and are not required to maintain their own PSC Register (see below for Scottish limited partnerships).

But the PSC regime is relevant for any UK companies under a limited partnership that investments are held through. This means that even though investors who use an English limited partnership will do so with a view to sharing profits derived from the underlying subsidiaries, the investors themselves are unlikely to meet the criteria to be registered in a PSC Register.

This is the case because there are specific rules for limited partnerships under which investors will (usually) not meet the Conditions (i) if they are solely limited partners, on the basis they will not be regards as meeting the criteria to qualify as holding an indirect interest, (ii) interests in vehicles underneath a limited partnership are held by the general partner in its own name for the benefit of the limited partnership’s partners and (iii) as matter of limited partnership law, a general partner must have discretion for the day-to-day management of the limited partnership’s affairs to the exclusion of the limited partners as a condition of the limited partners’ limited liability.

As a consequence, the general partner will usually be a PSC, whether they are an individual or an RLE, and will therefore be registrable on the PSC Register of the company.

Scottish limited partnerships have legal personality and, together with Scottish general partnerships where all the partners are corporate bodies, are required to deliver and maintain PSC information on the central register at Companies House.

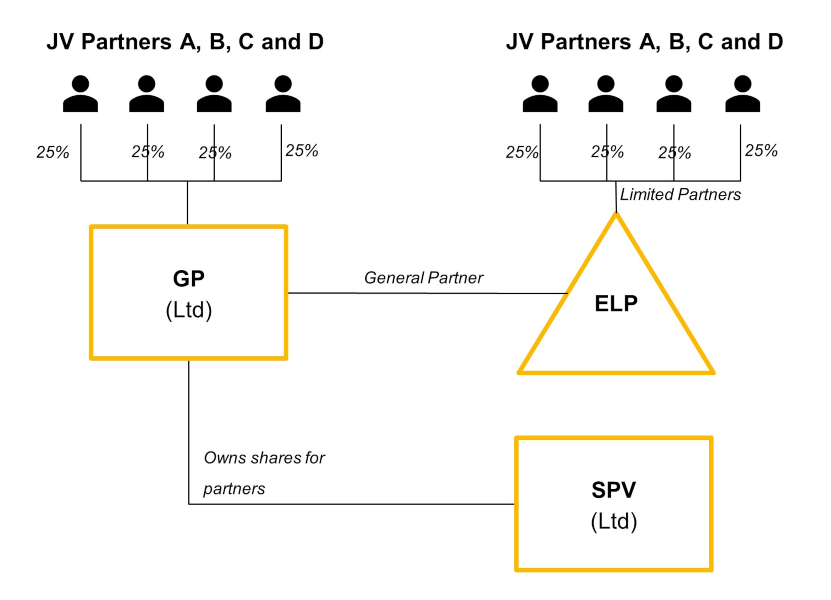

Example 3: Limited Partnerships:

- ELP is not within the scope of the PSC regime.

- GP, as an English limited company, records Manager as its PSC.

- SPV identifies GP as its PSC on the grounds that it is an RLE subject to the requirement to maintain its own PSC Register. Manager owns an indirect interest but as outlined in Example 1, need not be recorded in the PSC Register. The Investors do not satisfy the test for indirect control, so even though they are beneficially entitled to SPV’s distributions under the terms of the limited partnership deed, they do not meet the Conditions and therefore do not need to be registered.

Note, if ELP is a Scottish limited partnership, then the analysis would be different. The Scottish limited partnership would be entered as the RLE on SPV’s PSC Register and would then need to consider the entries on its own PSC Register, including (i) if the Investors are PSCs (for example, if they are entitled to more than 25% of the surplus assets on a winding-up) and (ii) if GP is an RLE.

v. Joint ventures (“JVs”), joint interests and joint arrangements

Identifying PSCs and RLEs may be more complicated when considering JV structures and more complex arrangements generally. If JV partners have different roles and holdings in the venture, then an analysis of each of the Conditions against the rights each JV partner has will need to be undertaken.

Only one of Conditions 1-4 need be met for a JV partner to satisfy the criteria but where rights are held evenly in a multi-party arrangement, it is also possible for the entity to submit to the registrar that “the company knows or has reasonable cause to believe that there is no registrable person or registrable relevant legal entity in relation to the company”.

Example 4: Joint Ventures:

- ELP is not within the scope of the PSC regime.

- GP, as an English limited company, records no PSC if the JV Partners rank equally economically and in respect of the governance arrangements. If, for example, a single JV Partner is delegated responsibility for managing the affairs of the joint venture, however, (Condition 4) then it alone will be recorded as GP’s PSC.

- SPV identifies GP as its PSC on the grounds that it is a RLE subject to the requirement to maintain its own PSC Register. As above in Example 3, the JV Partners as limited partners do not need to be recorded in SPV’s PSC Register.

vi. Interests in companies held through trusts

If a company is owned by a trust and that trust is a discretionary trust (such as a Jersey property unit trust scheme), an analysis will need to be undertaken to determine whether the trustee(s) will have to be entered onto the PSC Register. Where rights, shares or interests are held jointly by one or more persons (for example, joint trustees), each joint holder is treated as holding all of those rights, shares or interests and will need to each be entered onto the PSC Register as a separate PSC.

Trustees of a bare trust will be treated as nominees, meaning the shares will be treated as held by the beneficiaries on whose behalf they act. Beneficiaries who have the right to exercise significant influence or control over the trust would be shown on the PSC Register as they meet Condition 5.

Where a trustee is a corporate, the general rules on registrable and non-registrable RLEs will apply.

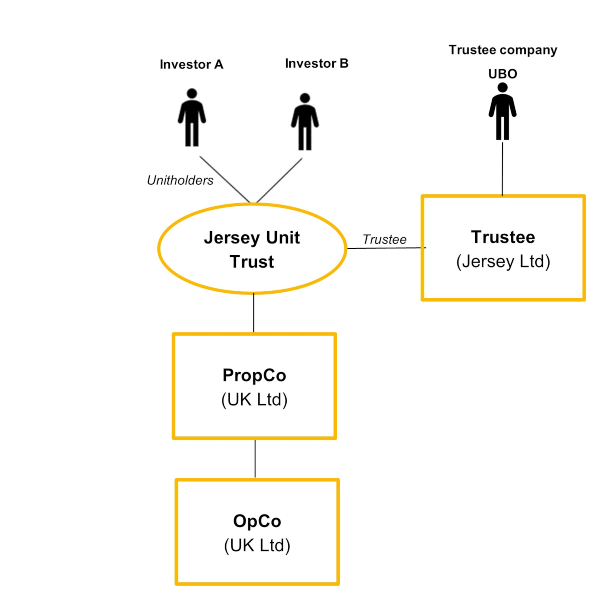

Example 5: Jersey Unit Trust:

- As they are established under Jersey law, neither the Jersey Unit Trust nor the Trustee are subject to the PSC regime.

- PropCo must understand the terms of the trust instrument governing the Jersey Unit Trust. To the extent it grants discretionary rights to Trustee over the trust’s assets in a way that that means neither of the unitholders exert “significant influence” or “control”, then Trustee will need to be considered. As a Jersey limited company, Trustee does not fall within the PSC Regime and assuming its shares are not listed on a relevant regulated market, it will not be an RLE. Accordingly, an analysis of Trustee’s ownership against the Conditions will need to be undertaken to determine if its beneficial owners need to be entered onto PropCo’s PSC Register.

- OpCo identifies PropCo as its PSC on the grounds that it is a RLE subject to the requirement to maintain its own PSC Register.

What information must be included on the PSC register?

A company’s PSC Register cannot be left blank. Unless no one person meets the criteria, it must always include information about its PSCs or registrable RLEs, although it cannot enter incomplete or unconfirmed information. In these circumstances the company must explain the status of the investigation into its PSCs or registrable RLEs, which could include, for example, a statement that (i) the company is taking reasonable steps to identify its PSCs or registrable RLEs, or (ii) information cannot be confirmed, or (iii) the person or entity that the company thinks is a PSC or registrable RLE is not responding to notices.

Content of the PSC Register:

| PSC | RLE |

|---|---|

| Full name | Company name |

| Date of birth | Address of registered or principal office |

| Nationality | Legal form of the entity and governing law |

| Country, state or part of the UK where you usually live | Company registration number and place of registration |

| Service address/ usual residential address | Date on which RLE became registrable (6 April 2016 for existing RLEs when the regime initially came into force) |

| Date on which PSC became registrable (6 April 2016 for existing PSCs when the regime initially came into force) | Official wording describing which of the five conditions met for being a RLE |

| Official wording describing which of the five conditions met for being a PSC | |

| Any restrictions on disclosing the PSC's information that are in place |

What are the penalties and sanctions for non-compliance with the regime?

Entities that fail to provide information on PSC/RLE interests when required could be committing a criminal offence and are liable to be fined. Officers of companies, designated members of LLPs and partners of Eligible Scottish Partnerships who are in default could be committing a criminal offence punishable by up to two years’ imprisonment and/or a fine.