Authors

The concern that countries with significant economic strength, such as the United States, could enter an eventual recession, the consequences that we are still experiencing from the Covid-19 pandemic and the rise in prices of raw material; has caused an important impact from which emerging countries cannot escape. Such is the case of Colombia, where, in addition to enduring a notable increase in inflation in recent months –with a relatively stable dollar – we now face the highest price the US dollar has ever been against our peso 1 .

As a response to this situation, the Colombian National Bank has increased intervention rate in monetary policy, also known as reference rates, going from 6% to 7,5%. As this information has been recently and frequently spread through different media, our purpose here is to give a brief explanation of the basis of this measure, what the reference rate is and some consequences of what this entails.

First: The legal basis

As a result of the measures taken by recommendation of the Kemmerer mission, invited by President Pedro Nel Ospina’s Government in the 1920s, the Colombian financial system ceased to be made up of private banks in order to implement a central bank too, Banco de la Republica, which was established on the ashes of the now defunct Lopez Bank (Banco Lopez).

The creation of the Colombian Central Bank was accompanied by the assignment of various faculties as the “banker of banks” - which occurs, for example, when it lends resources to commercial banks -, and as an exchange, monetary and credit authority, powers that are carried out through its Board of Directors. Said faculties are found in Law 31 of 1992.

Second: The reference rate

The intervention or reference rate is one of the main instruments, if not the main one, that the Colombian Central Bank has to intervene in monetary policy, a mechanism through which it influences the level of inflation, economic growth and purchasing power of money 2 . As said by the Central Bank, this rate “is known as the intervention rate because it is the rate at which the central bank intervenes directly in the money market to provide or extract liquidity from the system; as reference rate because it is used to calculate other interest rates, and as monetary policy because with it, the monetary authority defines its policy position with the purpose of driving inflation to its goal” 3 .

Briefly, the intervention rate is the rate or interest charged by the Central Bank to the financial entities to which is provides liquidity.

Third: Consequences

Adjustments in the reference rate of the Colombian Central Bank condition, to a large extent, the mobilization of capital within the country. When these are lowered, as it occurred from March 2020 to September 2021, the volume of money in the economy expands. On the other hand, when these go up, as is the case, the available money, including that to which one has access through credit, decrease, therefore obtaining it becomes more expensive and this causes general spending to reduce.

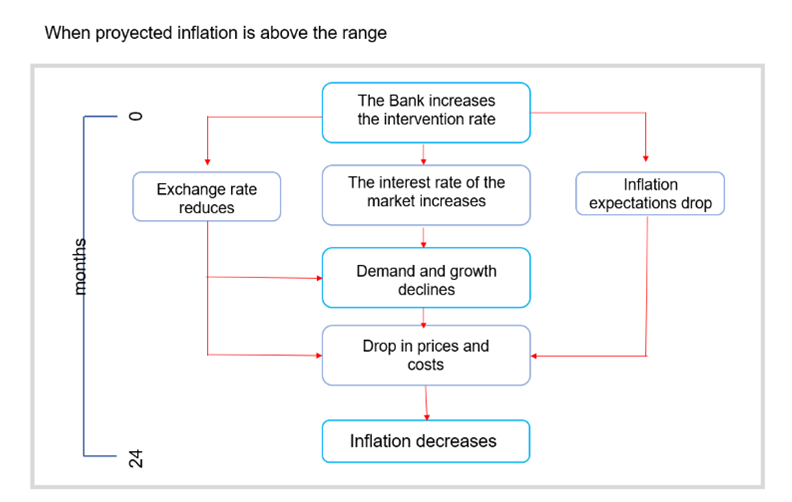

Although this may initially seem counterintuitive –since, reasonably, what is most wanted in the absence of money, is that it appears to us-; truth is, these measures protect the country’s economy and that of the community. One of the motives for this is that the disincentive for spending, in a certain way, forces saving and forces being conservative with what is acquired, thus reducing demand and as a result of this, the generalized and sustained increase of prices is contained, i.e., inflation. For better understanding, we present the following graphic:

We invite our readers to consult the Colombian Central Bank portal (https://www.banrep.gov.co/es) to keep updated on the subject.