Management fees

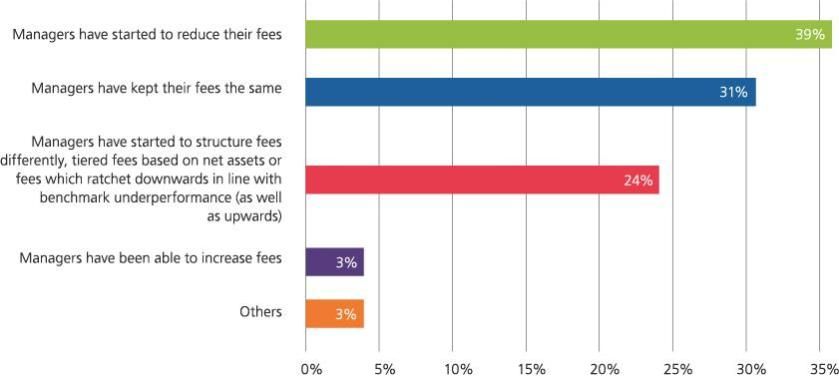

Survey Responses: Management Fees for closed-ended private funds

Among investors and managers we surveyed, 39% believe that managers have started to cut their fees, while 31% think fees are stable. Where our study reveals there is some downward pressure on fees, this not true in all cases.

Our research suggests that fees charged by managers (in 2020 compared to 2019) have not materially changed – in contrast to the period after the 2008 financial crisis. Market forces and some regulatory pressure have led some fund managers to reassess their positions, but where funds are oversubscribed or where a manager inhabits a niche or underserved market, fees have largely remained stable. Eric Byrne, Head of Multi-Managers, REPM at UBS Asset Management, says it’s simply a case of supply and demand: “Where you have a situation where you’ve got good performing or reasonably performing private market funds, that have capacity constraints, and demand is in excess of supply, then managers are able to keep their fees at the same level that they planned. And quite simply, if someone doesn’t want to pay those fees, they don’t go into the fund.” Austin Mitchell, Head of International Housing and Global Strategy at Nuveen agrees: “Investors are happy to pay for performance, especially with operationally intensive and alternative real estate sectors when there is material demand”

For investment strategies and geographies that are occupied by a number of competing funds, there is greater downward pressure on fees as managers compete for capital. “There are some pockets of downward fee pressure but this is more prevalent in parts of the industry where 1) there are options and choice for investors, and 2) fees represent a greater proportion of forecast performance i.e. core”, Austin Mitchell comments.

Our data indicates that some managers are adopting different tiered fees based on net assets or fees tied to key metrics such as performance and ESG impact.

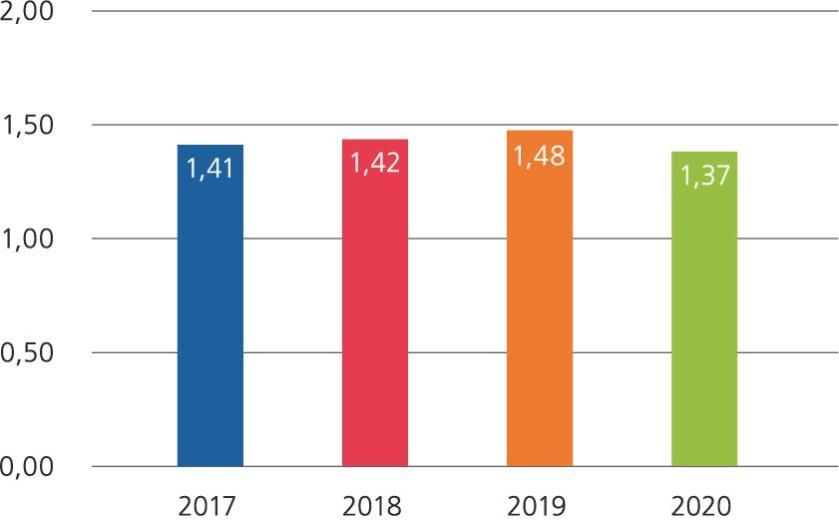

Real Estate Sample Funds – Investment Period Average Management Fee by Vintage Year

From our real estate Sample Funds 2020 shows a slight dip in management fees, but this is small and not statistically significant. The data from our Sample Funds is consistent with our survey, which suggests that management fees have remained stable for funds that are performing well in the right sectors.

Our Sample Funds show typical closed-ended real estate funds charge a Management Fee with a range of about 1.3%–1.5%. Private equity funds typically receive slightly higher fees up to a maximum of circa 2%. However, discounts for cornerstone or first close investors are common. Venture capital funds’ management fees are typically in the region of 2.25% to 2.5%