Fund terms

Following the 2008-2009 global financial crisis, investors were initially reluctant to commit to funds and this tended to lead to more investor-friendly terms. However, from the end of the global financial crisis until the arrival of Covid, investors invested large amounts into private funds searching for yield as well as capital growth. For many managers this tipped the balance of power back in favour of fund managers.

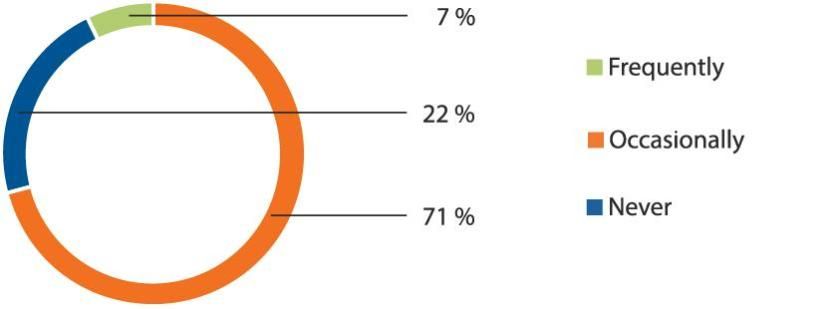

Post-Covid there are signs the balance of power has started to tip back in favour of the investor as our survey indicates that investors are willing to occasionally walk away from funds if terms are unattractive. In our survey, 71% said investors occasionally walk away for this reason. Clearly, fund terms and conditions are critical to an LP’s decision-making process and commitments can fall through because the manager and investor cannot agree terms.

Many interviewees felt that fund terms have not significantly changed, but there is a theme of market conditions becoming more challenging for managers to achieve terms in their favour compared to the 2019 high point.

Covid has had a negative impact on fundraising in some sectors such as real estate. Given current market conditions, fund managers may, as in 2009-2011, look to attract investors by offering more investor-friendly terms.

However, there is evidence of the emergence of increasing polarisation in the market with respect to the balance of power between managers and investors. The best managers continue to have sufficient demand to obtain GP-friendly terms and fees. At the other end of the market, lesser performing or new market entrants face more competition to raise capital and therefore investors are able to dictate LP-friendly terms and fee discounts.

The chart below shows the response to our survey question: Have you decided, or had a potential investor decide, not to invest in a Fund due to the proposed Fund terms and conditions?