Sustainable Finance

Key contacts

In the European Green Deal, the European Union has committed to becoming the first climate-neutral economic area in the world by 2050. In the pursuit of this goal, net greenhouse gases are to be reduced by 55 percent below the 1990 level by 2030. For this to be achieved, more (private) capital needs to flow into climate-friendly projects and companies. The financial sector has a key role in the implementation of this plan: it must mobilise the resources for the necessary transformation of the real economy.

The market is already developing rapidly. The main focus is on ESG and impact funds, green financial products, such as green bonds, as well as green and sustainability linked loans in the financing sector, amongst other things.

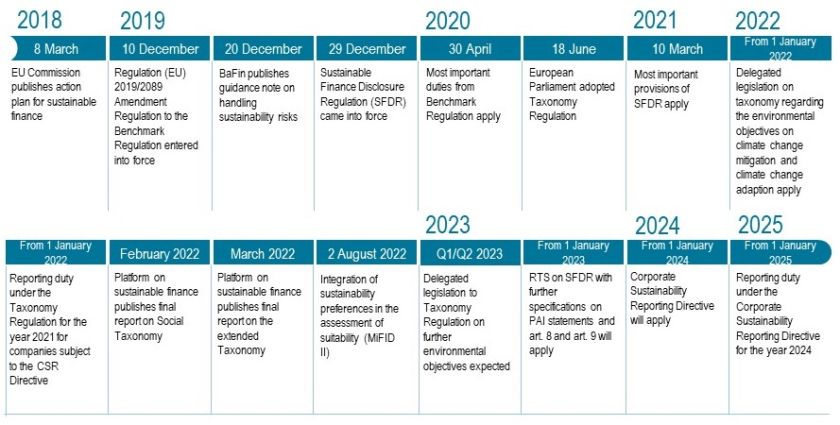

The sustainable finance package of the EU which was already launched in 2018 is intended to create further incentives for environmentally friendly investments. Central measures are, in particular, the Taxonomy Regulation, the Disclosure Regulation (SFDR) and the integration of sustainability preferences into the MiFID II regime. We have provided a brief overview below:

Taxonomy Regulation

The Taxonomy Regulation defines which economic activities are sustainable and for the first time creates a legally binding standard for sustainable investment. The Taxonomy Regulation is the core of the sustainable finance legislative package and the centre of reference for a wide range of measures. The Taxonomy Regulation applies in the following contexts:

- As a basis for issuers of green financial products or corporate bonds (e.g., European green bond standard),

- Financial market participants who set up financial products in accordance with the Disclosure Regulation, e.g., portfolio management, investment funds,

- Undertakings that are obliged to publish so-called "non-financial statements" under the CSR Directive.

Disclosure Regulation

The Disclosure Regulation regulates company and product-related transparency requirements for financial market participants. Central pillars are:

- Dealing with sustainability risks,

- Dealing with Principal Adverse Impacts,

- Classifying financial products according to their sustainability (Art. 8 and Art. 9).

Integration of sustainability preferences, MiFID II

With the amended Delegated Regulation (EU) 2017/565 on MiFID II, investment advisors and portfolio managers will be required to actively seek information on investors' sustainability preferences and recommend products that meet these. This extends the assessment of suitability, which has so far focused on return, risk and liquidity, to include the criterion of sustainability.

(Last updated: 30.01.2023)

Our Sustainable Finance team advises on the following topics:

- Green loans, social loans and sustainability-linked loans (including promissory note loans)

- Green bonds, social bonds and sustainability-linked bonds

- ESG compliance

- Sustainability-related disclosure obligations and implementation of further regulatory requirements

- Setting up ESG and impact funds

Legal experts for Sustainable Finance

Explore more

We would be pleased to advise you on any issues around ESG regulatory proposals, in particular the Taxonomy Regulation, the Disclosure Regulation and MiFID II, and on general questions relating to sustainable finance. Please contact us.

Your request has been successfully sent to the service team. They will get back to you in the next few days.